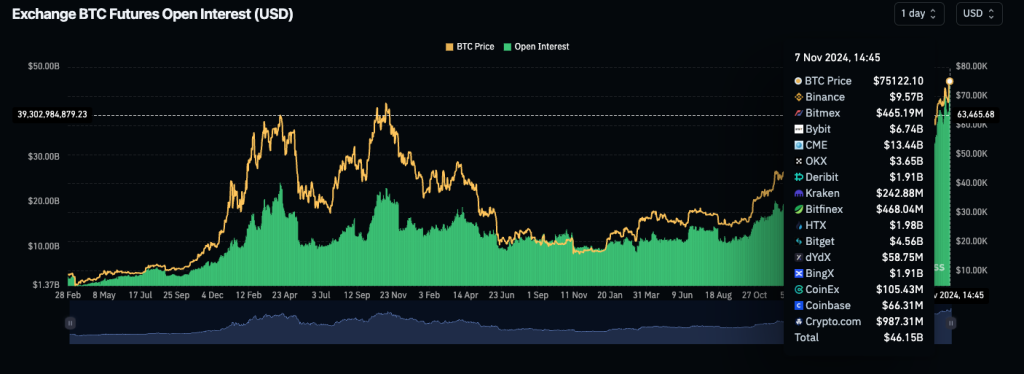

“Bitcoin Open Interest Hits $45.4 Billion on Nov. 6 as Trump Wins US Election and Bitcoin Reaches Fresh Highs.”

Bitcoin Open Interest (OI) climbed to a record high as Bitcoin rallied to $75,000, with analysts suggesting further upside potential. The OI, which measures the total number of open Bitcoin derivative contracts like options and futures, reached $45.4 billion—up 13.3% since Nov. 5, when Bitcoin surpassed its previous all-time high of $73,800 set in March, according to CoinGlass data.

In the crypto market, open interest (OI) refers to the total number of active or unsettled contracts in derivatives markets, such as futures and options, at a given time. Open interest is an important indicator of market activity and investor interest in a particular asset. Here’s how it works in more detail:

- Open Contracts: Open interest includes all the outstanding contracts that have not been closed, expired, or settled by an offsetting trade. For example, in Bitcoin futures, open interest measures the number of active Bitcoin contracts that traders hold.

- Market Sentiment: A rise in open interest generally signals that more money is entering the market and that current price trends may continue. Conversely, a drop in open interest could indicate a cooling of the trend or profit-taking.

- Liquidity and Volatility: High open interest can improve market liquidity, making it easier to enter or exit positions. It’s also often associated with increased volatility, as high levels of open contracts mean more traders are actively speculating on price movements.

- No Direct Impact on Price: Open interest itself doesn’t directly impact the price of the underlying asset, but it reflects market activity and can help analysts gauge the strength or weakness of a price trend.

For example, if Bitcoin open interest is high and rising alongside a price increase, it may suggest strong bullish sentiment. But if open interest rises while prices drop, it could indicate bearish sentiment.